What Are the Loan Consolidation Eligibility Requirements?

Understanding Loan Consolidation Eligibility Requirements

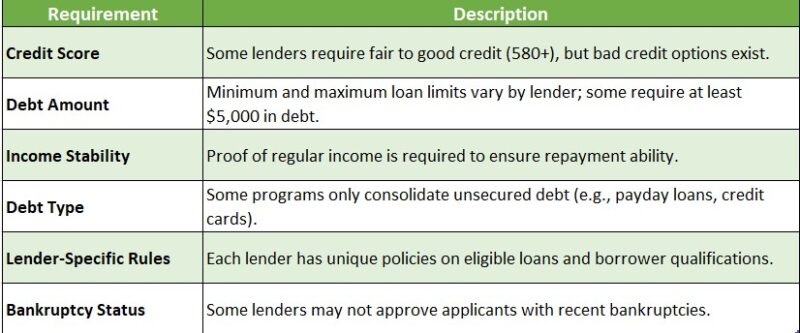

Understanding the loan consolidation eligibility requirements is essential, as not everyone qualifies. Lenders typically assess several key factors, including your credit score, income level, and the types of debts you want to consolidate. A good credit score and steady income can lead to favorable terms, while a poor credit history may result in higher interest rates or limited options. Here are some common eligibility requirements to consider:

- Credit Score: Most lenders prefer a score of at least 650, although some may accommodate lower scores.

- Debt-to-Income Ratio: A ratio below 40 percent is ideal, meaning your monthly debt payments should not exceed 40 percent of your gross monthly income.

- Types of Debt: Not all debts qualify for consolidation; for instance, payday loan debt consolidation may have specific criteria.

- Employment Status: A stable job can enhance your chances of approval, demonstrating your ability to repay the loan.

In summary, knowing the loan consolidation eligibility requirements can help you make informed financial decisions. By evaluating your credit score, debt-to-income ratio, and the types of debts you wish to consolidate, you can navigate the process more effectively. Each lender may have unique criteria, so it’s beneficial to shop around for the best options. With proper preparation, you can take significant steps toward financial relief and a brighter future.

CashLoanFunded: Quick Cash for Your Needs!

Understanding loan consolidation eligibility is essential, as not everyone qualifies. A key factor is your credit score, which lenders use to gauge responsible borrowing habits. If your score is low, don’t worry; options exist, particularly for those seeking payday loan debt consolidation. Finding the right lender who understands your situation is crucial.

Another important aspect is your debt-to-income ratio, which compares monthly debt payments to income. A lower ratio indicates manageable debt, making you a more appealing candidate for consolidation. Additionally, the types of loans you want to consolidate matter. Most lenders prefer unsecured debts, like credit cards and personal loans, over secured debts such as mortgages or auto loans. Here are some key points to keep in mind:

- Credit Score: Aim for a score above 650 for better options.

- Debt-to-Income Ratio: Keep it below 40 percent for favorable terms.

- Types of Debt: Focus on unsecured debts for easier consolidation.

Lastly, your employment status and income stability can also affect eligibility. Lenders want assurance of a reliable income source to manage the new consolidated loan. If you meet these criteria, you are on your way to simplifying your financial life through loan consolidation.

Get Approved Fast at CashLoanFunded – No Hassle!

Types of Loans Eligible for Consolidation

When considering loan consolidation, it’s important to know which types of loans qualify for this financial strategy. Most unsecured loans, such as credit card debts and personal loans, are eligible for consolidation. If you have payday loans, you might be curious about how they fit in. Payday loan debt consolidation allows borrowers to combine multiple high-interest payday loans into a single, manageable payment, significantly reducing financial strain and helping regain control over finances. Common types of loans eligible for consolidation include:

- Credit Card Debt: Consolidating high-interest credit card balances can lower interest rates and simplify payments.

- Personal Loans: If you have several personal loans, consolidation can streamline your monthly obligations.

- Payday Loans: These short-term loans often carry high interest rates, making consolidation a smart choice to avoid a debt spiral.

- Student Loans: Both federal and private student loans can be consolidated, often resulting in lower monthly payments and extended repayment terms.

To qualify for loan consolidation, lenders typically assess your credit score, income, and overall debt-to-income ratio. Understanding your financial situation is crucial before proceeding. By consolidating your loans, you can simplify payments and potentially save on interest, making it a valuable option for anyone managing multiple debts.

Minimum Credit Score Requirements for Loan Consolidation

When considering loan consolidation, understanding the minimum credit score requirements is crucial. Most lenders typically seek a credit score of at least 620, although this can vary based on the type of debt being consolidated. For example, if you are looking into payday loan debt consolidation, some lenders may show flexibility, acknowledging the challenges of high-interest loans. A higher credit score can lead to better terms, making it essential to know your score before applying. Here are some key points regarding credit scores and loan consolidation eligibility:

- 620 or higher: This is the common baseline for many lenders.

- Improving your score: If your score is below this, consider steps like paying down debts or correcting errors on your credit report.

- Alternative options: Some lenders may provide consolidation options even for lower scores, particularly for payday loan debt, recognizing the urgency of escaping high-interest cycles.

Besides credit scores, lenders will evaluate your overall financial situation, including income and existing debts. This comprehensive approach helps them assess your ability to repay the consolidated loan. Therefore, if you are contemplating loan consolidation, reviewing your credit report and financial health is advisable. Being prepared can streamline the process and enhance your chances of approval.

Also Read: What Is Payday Loan Debt Consolidation and How Does It Work?

Income and Employment Criteria for Loan Consolidation

When considering loan consolidation, understanding the income and employment criteria is essential. Lenders want to ensure you have a stable income to manage your new loan payments. Whether you are a full-time employee, part-time worker, or self-employed, your income significantly impacts your eligibility. For freelancers, providing proof of consistent earnings can strengthen your application. Here are some key points regarding income and employment criteria for loan consolidation:

- Stable Income: Lenders prefer borrowers with a steady income stream, whether from a job, freelance work, or rental income. Consistency improves your chances of approval.

- Employment History: A solid employment history enhances your credibility. Lenders often look for at least two years in the same job or industry, indicating reliability.

- Debt-to-Income Ratio: This ratio compares your monthly debt payments to your monthly income. A lower ratio suggests you can cover your debts, making you a more attractive candidate for consolidation.

- Credit Score: While not directly tied to income, a good credit score can influence your eligibility, reflecting your ability to manage debt responsibly.

By meeting these criteria, you can position yourself favorably for loan consolidation, especially if dealing with payday loan debt consolidation. Each lender may have specific requirements, so it’s wise to shop around for the best fit.

How to Check Your Eligibility for Loan Consolidation

When considering loan consolidation, the first step is to check your eligibility. This process may seem daunting, but it is quite straightforward. Lenders typically evaluate several key factors to determine your qualification for consolidating loans, including your credit score, income level, and the types of debts you hold. For example, if you have both credit card debt and payday loans, consolidating them into a single loan can simplify payments and potentially lower interest rates. Here are some common eligibility requirements to keep in mind:

- Credit Score: Most lenders prefer a score of at least 580, though some may offer options for lower scores.

- Debt-to-Income Ratio: A lower ratio indicates manageable debt levels relative to your income, which is favorable for lenders.

- Employment Status: Having a steady job or income source can significantly enhance your approval chances.

- Types of Debt: Not all debts qualify for consolidation. For instance, payday loans may be eligible, depending on the lender’s policies.

Once you understand these requirements, gather your financial documents, such as your credit report and income statements. This preparation will help you present a strong case to lenders. Remember, consolidating your loans can ease your financial burden and improve your credit score over time if managed wisely.

Common Mistakes to Avoid When Assessing Eligibility

When considering loan consolidation, many people overlook the eligibility requirements, which can lead to common pitfalls. One major mistake is assuming that all debts qualify for consolidation. For instance, while student loans and credit card debts often make the cut, payday loans may not. Understanding what types of debt can be consolidated is crucial to avoid wasting time and effort on applications that will be denied.

Another frequent error is not checking your credit score before applying. Lenders typically have minimum credit score requirements, and if yours falls short, you may be setting yourself up for disappointment. It is wise to review your credit report and address any issues beforehand. Additionally, many borrowers forget to gather necessary documentation, such as income verification and existing loan details, which can delay the process. To ensure a smooth consolidation experience, keep these tips in mind:

- Research your options: Different lenders have varying eligibility criteria.

- Understand your debt: Know which debts you want to consolidate and their total amounts.

- Consult a financial advisor: They can provide personalized advice based on your financial situation.

By avoiding these common mistakes, you can enhance your chances of successfully consolidating your loans and achieving financial relief.

Steps to Take if You Do Not Meet Loan Consolidation Eligibility

If you find yourself in a situation where you do not meet the loan consolidation eligibility requirements, don’t worry. There are several steps you can take to improve your chances of qualifying for a consolidation loan in the future. First, it’s essential to understand why you might not be eligible. Common reasons include having a low credit score, being behind on payments, or having a high debt-to-income ratio. Knowing these factors can help you strategize your next moves. Here are some practical steps to consider if you do not meet the eligibility criteria for loan consolidation:

- Improve Your Credit Score: Start by checking your credit report for errors and disputing any inaccuracies. Pay down existing debts and make timely payments to boost your score over time.

- Create a Budget: A well-structured budget can help you manage your finances better and reduce your overall debt. This can also improve your debt-to-income ratio, making you more appealing to lenders.

- Consider Alternative Options: If loan consolidation is not an option, explore other avenues such as debt management plans or credit counseling services. These can provide guidance and support in managing your debts effectively.

- Stay Informed: Keep an eye on your financial situation and the lending landscape. Sometimes, lenders adjust their eligibility requirements, and what was once unattainable may become accessible later on.

FAQs

⭐ What is loan consolidation?

Loan consolidation combines multiple debts into one single loan with a fixed interest rate and structured repayment plan, making it easier to manage payments.

⭐ Who is eligible for loan consolidation?

Eligibility depends on the lender, but typically, you must have:

-

A stable source of income

-

A minimum credit score (varies by lender)

-

A manageable debt-to-income ratio

-

Existing loans that qualify for consolidation

⭐ Can I consolidate loans if I have bad credit?

Yes, but you may face higher interest rates. Some lenders offer consolidation loans for bad credit borrowers, but having a co-signer or improving your credit score can help secure better terms.

⭐ What types of loans can be consolidated?

Most personal loans, payday loans, credit card debt, and some student loans can be consolidated. However, mortgages and certain secured loans may not be eligible.

⭐ Does loan consolidation hurt my credit score?

Initially, your credit score may dip due to the hard inquiry from the lender. However, making consistent on-time payments can improve your score over time.

Secure Funds at CashLoanFunded – Get Cash Fast!

🔗At ExpressCash, we’re here to help guide you through the process and find the right financial solution for your specific situation.

Get a Loan!

"*" indicates required fields