What Is Payday Loan Debt Consolidation and How Does It Work?

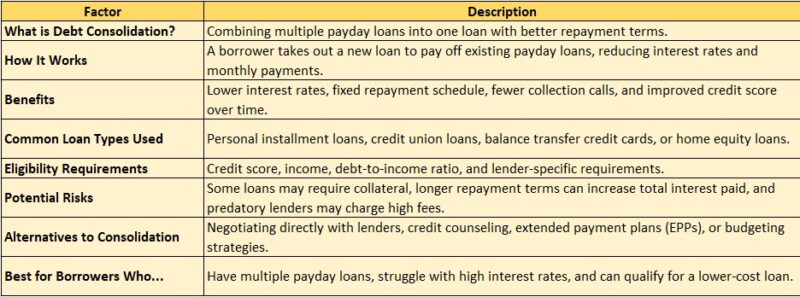

Understanding payday loan debt consolidation can significantly benefit those facing multiple high-interest loans. This process involves merging several payday loans into one manageable loan, simplifying payments and potentially lowering the overall interest rate. By consolidating, you can alleviate the stress of juggling various due dates and interest rates, bringing clarity to your financial situation. To begin with payday loan debt consolidation, assess your current loans and total debt. With a clear understanding, you can explore options like personal loans or debt management programs, which often provide lower interest rates and extended repayment terms. Here are some key benefits of this approach:

- Lower Interest Rates: Save money on interest over time.

- Single Payment: Manage only one monthly payment instead of multiple.

- Improved Credit Score: Successfully handling a consolidated loan can enhance your credit score over time.

Real-world examples highlight the effectiveness of payday loan debt consolidation. Take Sarah, for instance, who had three payday loans with interest rates over 400 percent. By consolidating her loans into a personal loan with a 15 percent interest rate, she reduced her monthly payment and embarked on a path to financial recovery. This strategy not only eased her stress but also empowered her to regain control over her finances. If you find yourself in a similar situation, considering payday loan debt consolidation could be a crucial step toward achieving financial freedom.

CashLoanFunded: Quick Cash for Your Needs

How Payday Loan Debt Consolidation Works

Managing multiple payday loans can be daunting, especially with high interest rates and tight repayment deadlines. This is where payday loan debt consolidation becomes a valuable solution. It involves merging several payday loans into one single loan that features a more manageable interest rate and payment schedule. This not only simplifies your financial situation but can also lead to significant savings over time. So, how does payday loan debt consolidation work? The first step is to assess your current loans by gathering details about each loan’s balance, interest rate, and repayment terms.

With this information in hand, you can approach a consolidation lender who will provide a new loan to pay off your existing debts. Typically, this new loan comes with lower interest rates and extended repayment terms, making monthly payments easier to handle. Here are some key benefits of this approach:

- Lower interest rates: Consolidation loans usually offer lower rates than payday loans, which helps reduce your overall debt burden.

- Single monthly payment: You only need to manage one payment instead of multiple ones.

- Improved credit score: Paying off payday loans can positively affect your credit score over time.

- Less stress: Simplifying your debt can lead to a more manageable financial situation.

In conclusion, payday loan debt consolidation can be a crucial lifeline for those overwhelmed by high-interest loans, allowing you to regain control of your finances and work towards a debt-free future.

Benefits of Consolidating Payday Loan Debt

Managing payday loan debt can often feel overwhelming, as many individuals find themselves trapped in a cycle of borrowing. This is where payday loan debt consolidation becomes a valuable solution. It involves merging multiple payday loans into a single loan with a more manageable payment plan. This not only simplifies your finances but can also lead to significant savings in interest and fees. Imagine the relief of having just one monthly payment instead of juggling several; it can truly transform your financial health. The benefits of consolidating payday loan debt are numerous. Here are some key advantages to consider:

- Lower Interest Rates: Consolidation often allows you to secure a loan with a lower interest rate than what you are currently paying on multiple payday loans, reducing your overall debt burden.

- Simplified Payments: You will only have one payment to manage, which minimizes the risk of missed payments and late fees.

- Improved Credit Score: Paying off your loans through consolidation can enhance your credit score over time, opening up more financial opportunities in the future.

- Stress Reduction: Managing one loan instead of several can significantly alleviate financial stress, allowing you to focus on other important aspects of your life.

To consolidate your payday loan debt, research reputable lenders offering consolidation loans. Gather your current loan details, compare offers, and apply for the loan to pay off your existing payday loans. This streamlined approach can lead to a healthier financial future, making it easier to regain control over your finances.

Get Approved Fast at CashLoanFunded – No Hassle!

Common Methods for Payday Loan Debt Consolidation

Managing payday loan debt can be daunting due to high interest rates and tight repayment deadlines. This is where payday loan debt consolidation becomes a valuable solution. It involves merging multiple payday loans into a single, more manageable loan, simplifying payments and potentially lowering overall interest costs. This method is particularly appealing for those struggling to keep up with various lenders. There are several effective methods for consolidating payday loan debt, each offering unique benefits. Here are some options to consider:

- Personal Loans: These loans, often available from banks or credit unions, typically feature lower interest rates than payday loans, enabling more efficient debt repayment.

- Credit Counseling: Engaging with a credit counselor can provide personalized strategies for managing debt, including negotiations with lenders and setting up a debt management plan.

- Debt Consolidation Loans: Specifically designed to combine multiple debts, these loans usually come with fixed interest rates and longer repayment terms, making monthly payments more manageable.

- Balance Transfer Credit Cards: If you have good credit, you may qualify for a balance transfer credit card offering a 0 percent introductory rate, providing temporary relief from interest while you pay down your debt. The ultimate aim of payday loan debt consolidation is to regain control over your finances.

By selecting the right method, you can alleviate stress, save money, and work towards a more secure financial future. Assessing your financial situation is crucial to choosing the best option for your needs.

Eligibility Criteria for Payday Loan Debt Consolidation

Managing payday loan debt can be daunting due to high interest rates and short repayment terms. This is where payday loan debt consolidation becomes a viable solution, allowing borrowers to combine multiple payday loans into a single, more manageable loan. However, understanding the eligibility criteria is essential to determine if this option suits your needs. To qualify for payday loan debt consolidation, lenders typically consider several key factors. A steady source of income is crucial, as it demonstrates your ability to repay the consolidated loan. While a good credit score can enhance your chances of approval, some lenders cater to those with less-than-perfect credit histories. Here are common eligibility criteria you may encounter:

- A consistent income source, such as employment or government benefits

- A minimum credit score, with some lenders offering flexibility

- Documentation of your financial situation

- A reasonable amount of existing payday loan debt to consolidate

Meeting these criteria can significantly help you regain control over your finances. For instance, consider a borrower with three payday loans totaling two thousand dollars at high interest rates. By consolidating these loans, they could lower their monthly payments and reduce overall interest, easing their financial burden. This approach not only simplifies repayment but also provides a clearer path towards financial stability.

Potential Risks of Payday Loan Debt Consolidation

When considering payday loan debt consolidation, it’s essential to weigh the potential risks involved. While this strategy can simplify your payments and potentially lower your interest rates, it is not without its pitfalls. One of the primary concerns is the possibility of falling into a cycle of debt. If you consolidate your payday loans but do not change your spending habits, you might find yourself taking out new loans to cover your expenses, leading to an even larger debt burden. Another risk is the fees associated with consolidation services.

Many companies charge high fees for their services, which can negate any savings you might achieve through lower interest rates. It’s crucial to read the fine print and understand all costs involved before committing to a consolidation plan. Additionally, some consolidation loans may require collateral, putting your assets at risk if you fail to repay the loan. To navigate these risks effectively, consider the following tips:

- Research thoroughly: Look for reputable companies with transparent fee structures.

- Evaluate your budget: Ensure you can manage the new payment plan without incurring additional debt.

- Seek professional advice: Consulting with a financial advisor can provide personalized insights tailored to your situation.

By being aware of these potential risks and taking proactive steps, you can make informed decisions about payday loan debt consolidation that align with your financial goals.

Steps to Successfully Consolidate Payday Loan Debt

Being trapped in payday loans can be daunting, but payday loan debt consolidation provides a viable solution. This process merges multiple loans into one manageable payment, simplifying your finances and potentially lowering your overall interest rate. Here’s how to navigate this path to financial relief.

- Assess Your Current Debt: Begin by cataloging all your payday loans, noting the amounts owed and their interest rates. This assessment will clarify your financial landscape.

- Research Consolidation Options: Explore different consolidation methods, such as personal loans or debt management programs. Each option has unique advantages, so select one that aligns with your situation.

- Apply for a Consolidation Loan: After identifying a suitable option, apply for the loan, ensuring it offers a lower interest rate than your existing payday loans.

- Pay Off Your Payday Loans: Use the consolidation loan to fully pay off your payday loans, a critical step in breaking the debt cycle.

- Create a Budget: Post-consolidation, establish a budget to manage your new loan payments and prevent falling back into debt.

- Monitor Your Progress: Track your payments and celebrate small milestones. Staying motivated is essential for long-term success.

By adhering to these steps, you can effectively consolidate your payday loan debt and regain financial control. Many have successfully completed this process, alleviating the burden of high-interest payments and the stress of managing multiple loans. The ultimate aim is to not only consolidate but also to develop a sustainable plan for a debt-free future.

Finding the Right Debt Consolidation Service for Payday Loans

Finding the right debt consolidation service for payday loans can be daunting, but it doesn’t have to be. Payday loan debt consolidation allows you to merge multiple payday loans into a single loan with a lower interest rate and more manageable payment terms. This process can help you regain control of your finances and alleviate the stress of managing multiple payments. So, how do you choose the right service? Start by assessing the reputation of the debt consolidation service. Look for reviews and testimonials from past clients to evaluate their effectiveness.

A trustworthy service should have a proven track record of helping individuals consolidate their payday loans successfully. Additionally, check for accreditation from organizations like the Better Business Bureau to ensure credibility. When considering potential services, keep these essential points in mind:

- Transparency: Ensure they clearly outline their fees and terms to avoid hidden costs.

- Customer Support: Opt for a service that provides excellent customer support, making it easy to address any questions or concerns.

- Personalized Solutions: A good service will tailor their approach to your unique financial situation instead of offering a generic solution.

- Flexible Payment Options: Look for services that offer various payment plans to fit your budget.

- Educational Resources: A reputable service should also provide resources to help you better understand debt management.

FAQs

-

What is payday loan debt consolidation?

Payday loan debt consolidation is the process of combining multiple payday loans into a single loan with a lower interest rate and a structured repayment plan. -

How does payday loan consolidation work?

A consolidation lender pays off your existing payday loans, and you repay the lender through fixed monthly payments, often at a lower interest rate than payday loans. -

Can I consolidate payday loans with bad credit?

Yes, some lenders offer debt consolidation loans for bad credit borrowers, but interest rates may be higher. Alternatives include credit counseling services and debt management programs. -

What are the benefits of consolidating payday loans?

Consolidation can help lower interest rates, reduce fees, simplify payments, and prevent rollovers that trap borrowers in a debt cycle. -

Are there alternatives to payday loan consolidation?

Alternatives include negotiating directly with lenders, seeking credit counseling, using a personal loan, or applying for a balance transfer credit card to manage debt more effectively.

Secure Funds at CashLoanFunded – Get Cash Fast!

🔗At ExpressCash, we’re here to help guide you through the process and find the right financial solution for your specific situation.

Get a Loan!

"*" indicates required fields