What Payday Loan Debt Settlement Options Are Available?

Understanding Payday Loan Debt Settlement Options

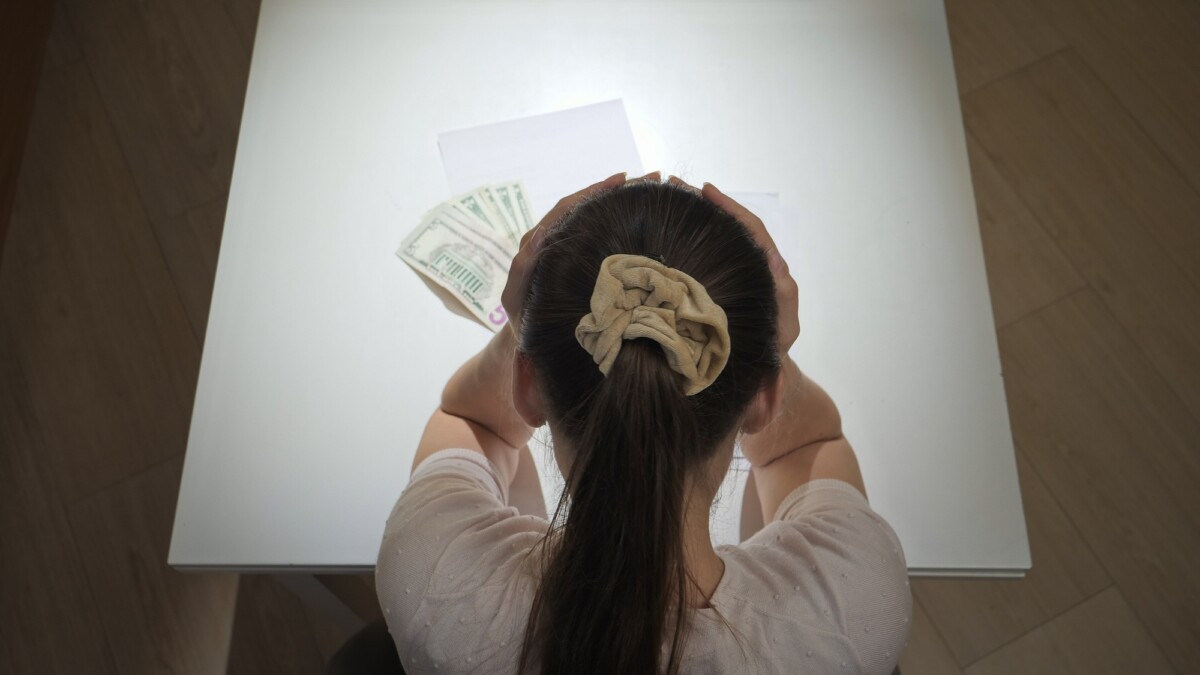

Feeling overwhelmed by payday loan debt is common, but understanding Payday Loan Debt Settlement Options can help you regain financial control. These options are designed to ease your burden and provide relief.

Payday Loan Debt Settlement involves negotiating with lenders to reduce the total amount owed, allowing you to pay a portion instead of the full amount. This can significantly alleviate financial stress. Key benefits include reduced debt, avoiding bankruptcy, and achieving peace of mind.

Alternatively, Payday Loan Debt Consolidation combines all your payday loans into one with a lower interest rate, simplifying payments and potentially saving money. Benefits include a single monthly payment, lower interest costs, and an improved credit score through consistent payments.

By understanding these options, you can make informed decisions about your financial future. Remember, taking the first step towards managing your debt is crucial and empowering.

CashLoanFunded: Quick Cash for Your Needs!

Feeling overwhelmed by payday loans is a common struggle, trapping many in a debt cycle. Understanding Payday Loan Debt Settlement Options is essential to break free and regain financial control. These options, such as negotiating with lenders to reduce balances or extending payment periods, offer a path to financial freedom tailored to individual needs.

What Are Payday Loan Debt Settlement Options?

These strategies aim to reduce or eliminate payday loan debt, providing relief and a clearer financial future. By exploring these options, individuals can find a solution that fits their unique situation, helping them manage debt more effectively.

Benefits of Payday Loan Debt Consolidation

- Simplified Payments: Merging multiple loans into one simplifies management.

- Lower Interest Rates: Consolidation often reduces the interest burden.

- Stress Reduction: Fewer bills lead to less stress and more peace of mind.

Exploring these options can transform financial stress into stability. Taking the first step is challenging but crucial for achieving financial peace.

How Do Payday Loan Debt Settlement Options Work?

Caught in the whirlwind of payday loans? Don’t worry, there are ways to manage this debt! Payday Loan Debt Settlement Options are crucial for regaining financial control. Debt settlement involves negotiating with your lender to reduce the total amount owed, potentially paying less than you borrowed. This can be a lifesaver if you’re struggling with multiple loans.

Payday Loan Debt Consolidation is another option, combining all your payday loans into one with a lower interest rate. This turns several high-interest loans into one manageable payment, reducing stress and simplifying your finances.

Benefits of Debt Settlement and Consolidation include:

- Reduced Stress: Simplifies payments into one manageable amount.

- Lower Payments: Potentially lowers the total amount you need to pay.

- Improved Credit: Successfully settling or consolidating can improve your credit score over time.

Understanding these options is the first step towards financial freedom. Research and choose the option that best fits your situation.

Get Approved Fast at CashLoanFunded – No Hassle!

Exploring the Pros and Cons of Payday Loan Debt Settlement

Payday Loan Debt Settlement Options provide a way out for those overwhelmed by payday loans, helping regain financial control. These options involve negotiating with lenders to reduce the total debt, offering relief if payments become unmanageable. However, it’s crucial to consider both pros and cons. Pros include potentially reduced debt, consolidating multiple loans into a single payment, and alleviating financial stress. Cons involve possible credit score impacts and fees charged by settlement companies.

Another alternative is Payday Loan Debt Consolidation, which combines all payday loans into one with a lower interest rate, simplifying payments and potentially saving money. As with any financial decision, it’s essential to assess if this option suits your situation. By exploring these solutions, you can effectively manage payday loan debt, aiming for a path that best supports your financial health.

Also Read: What Is Payday Loan Debt Consolidation and How Does It Work?

Can Payday Loan Debt Settlement Affect Your Credit Score?

Managing multiple payday loans can feel overwhelming, but Payday Loan Debt Settlement Options offer a way to regain control. These options can help reduce your debt, though they might temporarily impact your credit score. Debt Settlement involves negotiating to pay less than owed, which can lower your score but is preferable to defaulting. On the other hand, Payday Loan Debt Consolidation combines multiple loans into one, often with a lower interest rate and single monthly payment. This approach can simplify debt management and potentially improve your credit score with consistent payments.

- Pros of Debt Consolidation:

- Lower interest rates

- Single monthly payment

- Potential credit score improvement

- Cons of Debt Settlement:

- Temporary credit score drop

- Possible fees

Ultimately, while these options can affect your credit score, they provide a path to financial relief. Carefully considering the pros and cons will help you choose the best strategy for your financial situation.

Comparing Payday Loan Debt Settlement Options: Which is Right for You?

Facing payday loan debt can be overwhelming, but there are options to help you regain control. Understanding these payday loan debt settlement options is crucial for reducing stress and managing your finances effectively.

Understanding Payday Loan Debt Settlement

Debt settlement involves negotiating with lenders to lower the total amount owed, potentially allowing you to pay less than originally borrowed. This can provide significant financial relief if you’re struggling with multiple loans.

Exploring Payday Loan Debt Consolidation

Debt consolidation combines all your payday loans into a single loan with a lower interest rate, simplifying payments and potentially speeding up debt payoff. This option reduces the number of payments you need to manage.

- Benefits of Debt Consolidation:

- Lower interest rates

- Simplified payments

- Faster debt payoff

Choosing the Right Option for You

Choosing between settlement and consolidation depends on your financial situation. If multiple loans are overwhelming, consolidation might be best. However, if reducing the total owed is your goal, settlement could be more beneficial. Evaluate your needs and consult a financial advisor to make the best decision.

What to Expect During the Payday Loan Debt Settlement Process

Dealing with payday loan debt can be daunting, but knowing your options can ease the stress. Payday Loan Debt Settlement Options are designed to help manage and reduce debt, offering relief from high-interest rates. You can negotiate directly with lenders to lower your debt or choose Payday Loan Debt Consolidation to combine loans into one with a potentially lower interest rate. Each choice has its own advantages and disadvantages, so careful consideration is crucial.

The settlement process involves negotiating with lenders, possibly agreeing to a lump sum payment that’s less than the total owed, or setting up a more manageable payment plan. Patience and persistence are essential during these negotiations.

Debt settlement can provide several benefits, such as reduced debt, simplified payments through consolidation, and lower interest rates, which can save money over time. By understanding these options, you can regain control of your financial future and choose a path that suits your needs.

Common Mistakes to Avoid in Payday Loan Debt Settlement

Navigating payday loan debt settlement options can be a lifesaver, but it’s crucial to avoid common pitfalls. One frequent mistake is overlooking payday loan debt consolidation, which can simplify payments by merging multiple loans into one with a lower interest rate. This makes managing debt easier and reduces the risk of missed payments.

Another error is not fully understanding the terms of your settlement agreement. It’s essential to read all documents carefully and ask questions about any confusing terms to prevent unexpected fees or conditions that could worsen your financial situation.

- Read all documents carefully.

- Ask for clarification on confusing terms.

Additionally, failing to create a realistic budget can derail your efforts. A budget helps track spending and ensures you have enough to meet settlement obligations, preventing a quick return to debt.

- List all income and expenses.

- Set aside funds for loan payments.

By avoiding these mistakes, you can more effectively navigate payday loan debt settlement options and work towards financial freedom. Understanding your options and planning carefully are key to success.

How CashLoanFunded.com Can Help You Navigate Payday Loan Debt Settlement

Payday loans might seem like a quick solution during financial emergencies, but their high interest rates can trap you in debt. Understanding your Payday Loan Debt Settlement Options is essential to escape this cycle. Payday Loan Debt Consolidation is a popular method, allowing you to combine multiple loans into one manageable payment. Alternatively, negotiating with lenders to reduce the total debt is another option. Each choice has its advantages and disadvantages, and CashLoanFunded.com can guide you through them.

The benefits of debt settlement include lower monthly payments, reduced stress, and potentially improved credit scores. At CashLoanFunded.com, we provide personalized advice and resources to help you select the best debt settlement strategy. Our expert team is ready to support you every step of the way, empowering you to regain control of your finances and work towards a debt-free future.

Future Financial Planning: Life After Payday Loan Debt Settlement

Understanding payday loan debt settlement options is key to achieving financial freedom. These options help manage current debt and secure a stable financial future. Start by creating a budget to track income and expenses, ensuring you live within your means. Exploring payday loan debt consolidation can simplify payments and reduce stress by combining multiple loans into one with potentially lower interest rates.

Building an emergency fund is essential after settling payday loan debt. Save a small amount monthly to cover unexpected expenses, aiming for three to six months’ worth of living expenses. This fund prevents the need for future loans. Additionally, seeking financial advice can provide personalized strategies and help set realistic financial goals. Planning for the future is a journey, and each step brings you closer to financial stability.

FAQs

⭐ What is payday loan debt settlement?

Debt settlement is a process where you negotiate with lenders to pay a reduced amount instead of the full balance owed.

⭐ Can I settle my payday loan debt for less than I owe?

Yes, some lenders may accept a lump sum payment or a reduced settlement amount if you’re struggling to pay.

⭐ How do I negotiate a payday loan debt settlement?

You can contact your lender directly or work with a debt settlement company to negotiate a lower payoff amount.

⭐ Will settling my payday loan affect my credit score?

Yes, settled debts may be reported as “paid for less than the full amount”, which can negatively impact your credit score.

⭐ Are there alternatives to payday loan debt settlement?

Yes, alternatives include debt consolidation, extended repayment plans, or credit counseling services to manage your debt.

Secure Funds at CashLoanFunded – Get Cash Fast!

🔗At ExpressCash, we’re here to help guide you through the process and find the right financial solution for your specific situation.

Get a Loan!

"*" indicates required fields