Get Utility Bill Cash Help in Texas: Programs and Resources

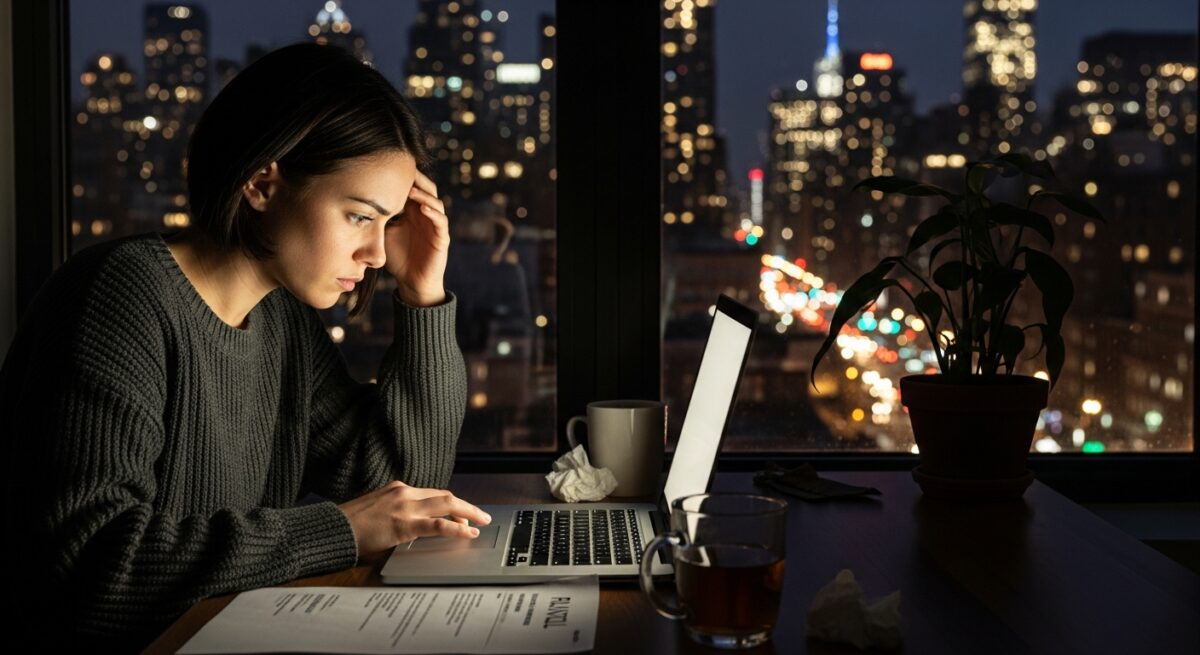

For many Texas families, the choice between keeping the lights on and putting food on the table is a harsh monthly reality. Skyrocketing temperatures, grid strain, and fluctuating energy costs can turn a simple utility bill into a source of profound anxiety. The fear of disconnection looms large, threatening not just comfort but safety and stability. If you’re searching for utility bill cash help in Texas, know that you are not alone, and more importantly, know that tangible financial assistance and relief programs do exist. Navigating the landscape of available aid can feel overwhelming, but understanding your options is the first critical step toward securing the support you need to regain control of your household finances and maintain essential services.

Visit Apply for Assistance to connect with your local Community Action Agency and secure your utility bill assistance.

Comprehensive State and Federal Assistance Programs

The cornerstone of utility bill assistance in Texas is a combination of federally funded, state-administered programs designed to provide direct financial aid to low-income households, seniors, and individuals with disabilities. These programs are not loans; they are grants or benefits that do not need to be repaid, offering a crucial lifeline for those experiencing financial hardship. The primary vehicle for this aid is the Comprehensive Energy Assistance Program (CEAP), which is Texas’s implementation of the federal Low Income Home Energy Assistance Program (LIHEAP). This program provides direct, one-time payments to utility companies on behalf of eligible households to help cover heating and cooling costs. Importantly, assistance is available for both electric and natural gas bills, and in some cases, for propane or other delivered fuels.

Eligibility for CEAP is primarily based on household income and size, typically requiring income at or below 150% of the Federal Poverty Level. The application process is managed locally through a network of Community Action Agencies (CAAs) and designated non-profit organizations across the state. These local agencies are your direct point of contact and can provide personalized guidance. They can also help you with the necessary documentation, which usually includes proof of income for all household members, copies of your utility bills, proof of identity, and Social Security numbers. It’s vital to apply as soon as you anticipate difficulty, as funds are distributed on a first-come, first-served basis and can be exhausted, especially during peak summer and winter months.

Utility Company Specific Payment Plans and Aid

Beyond state programs, your utility provider itself is often a critical first line of defense against disconnection. Texas law and Public Utility Commission rules require most regulated electric and water providers to offer deferred payment plans to customers who receive a disconnection notice. A deferred payment plan allows you to pay an overdue balance over time, typically in installments added to your regular monthly bills, while keeping your service connected. To qualify, you must contact your utility company directly, usually within a specific timeframe after receiving the disconnection notice. It is imperative to communicate with them before your service is cut off; once disconnected, reconnection fees and additional deposits can create a heavier financial burden.

Many major utility companies in Texas also operate their own charitable assistance programs, funded by customer donations and sometimes corporate matching. These programs, such as Reliant’s Caring Neighbor Program or TXU Energy Aid, provide bill-payment assistance to customers who meet certain criteria. The administration of these funds is frequently handled in partnership with local social service agencies or the Salvation Army. Furthermore, under the state’s Customer Protection Rules, certain vulnerable populations are offered additional safeguards. For example, a doctor’s certificate can prevent disconnection for a household with a serious medical condition, and disconnections are generally prohibited on weekends, holidays, or during extreme weather emergencies.

Local Community and Non-Profit Resources

A robust network of local non-profit organizations, charities, and religious groups across Texas provides direct utility bill cash help. These resources are often more flexible and can respond more quickly than larger state programs, though funding may be limited. The Salvation Army, Catholic Charities, and United Way agencies in cities like Houston, Dallas, San Antonio, and Austin frequently have emergency assistance funds for utilities. Local community action agencies, which also administer CEAP, may have additional discretionary funds from private grants or local government allocations. To access these resources, you will typically need to call or visit the organization, explain your financial crisis, and provide similar documentation as required for state programs.

It is wise to approach local resources with a strategic mindset. Begin by calling 2-1-1, Texas’s free, confidential social services hotline operated by the United Way. This service can provide a tailored list of organizations in your specific zip code that are currently offering utility assistance. When contacting a charity, be prepared to clearly explain your situation, including why you fell behind, what steps you’ve already taken, and how much you need to prevent disconnection or restore service. Many of these groups require that you have received a disconnection notice and may ask for a commitment or plan for maintaining future payments. Building a relationship with a caseworker at a local agency can also open doors to other forms of support, such as budgeting help, job placement services, or referrals to food pantries, which can free up household income for bills.

Strategic Steps to Secure Assistance and Manage Bills

Successfully navigating the process to get utility bill cash help in Texas requires a proactive and organized approach. Waiting until the day before disconnection limits your options and increases stress. The moment you realize you cannot pay a bill in full, you should initiate a clear action plan. Your first call should be to your utility provider to inquire about a deferred payment plan or any customer assistance programs they sponsor. This communication establishes a record of your intent to resolve the debt and can sometimes delay disconnection proceedings. Simultaneously, gather all necessary documents, including recent pay stubs, benefit statements, a photo ID, and your most recent utility bills.

Visit Apply for Assistance to connect with your local Community Action Agency and secure your utility bill assistance.

Next, prioritize applying for the broadest-based aid available, which is typically the state’s CEAP program through your local community action agency. Because these funds are limited, early application is crucial. While that application is processed, use the 2-1-1 service to identify local charities as a secondary or emergency layer of support. Be thorough and persistent; if one organization cannot help, ask if they can refer you to another. Managing this process effectively often means making multiple phone calls and possibly visiting agencies in person. Keeping a simple log of who you contacted, the date, the person you spoke with, and the outcome can prevent confusion and ensure follow-up.

- Contact Your Utility Provider First: Inquire about payment plans, extensions, and company-specific aid programs.

- Gather Documentation Immediately: Have proof of income, ID, Social Security cards, and current bills ready.

- Apply for State Assistance (CEAP): Locate your local Community Action Agency and submit an application promptly.

- Leverage 2-1-1 for Local Resources: Get a customized referral to charities and non-profits in your area.

- Explore All Avenues: Don’t stop at one application; pursue multiple sources of potential aid concurrently.

Finally, use this challenging period as a catalyst for long-term financial management. Once assistance is secured, work with a caseworker or a non-profit credit counselor to review your budget. Simple steps like conducting a home energy audit to seal drafts, adjusting thermostat settings by a few degrees, and using appliances during off-peak hours can lead to significant savings on future bills. Understanding the root cause of the financial shortfall whether it’s a temporary job loss, medical emergency, or chronic budget imbalance is key to preventing future crises.

Frequently Asked Questions About Texas Utility Bill Help

What is the difference between LIHEAP and CEAP in Texas?

LIHEAP (Low Income Home Energy Assistance Program) is the federal funding source. CEAP (Comprehensive Energy Assistance Program) is the name of the specific program administered by the Texas Department of Housing and Community Affairs that uses LIHEAP funds to assist Texans. When you apply for help in Texas, you are applying for CEAP.

Can I get help if I rent and my utilities are included in my rent?

Generally, CEAP assistance is paid directly to the utility company. If your landlord is the customer of record and bills you separately, you may not be eligible for CEAP. However, some local charities might offer assistance in the form of a grant to help you cover your rent payment that includes utilities. Always explain your specific situation to the agency.

What if I’ve already been disconnected?

Act immediately. Many programs, including CEAP and charitable funds, can still provide help to restore service, but you will likely need to pay a reconnection fee to the utility company. Be upfront about your disconnection status when you apply for aid, as some organizations prioritize households facing imminent disconnection, while others may have funds specifically for restoration.

Are there any free programs to help reduce my bill long-term?

Yes. The Weatherization Assistance Program (WAP), often coordinated through the same Community Action Agencies that run CEAP, provides free home energy upgrades to eligible low-income households. These improvements, like adding insulation or sealing leaks, can permanently reduce your energy consumption and bills. Also, some utility companies offer free energy efficiency kits or rebates for efficient appliances.

Do I have to be a U.S. citizen to receive utility bill cash help?

Eligibility requirements vary by program. For federally funded programs like CEAP, applicants must meet certain citizenship or qualified alien status requirements. However, many local charitable programs run by non-profits or religious organizations do not have the same restrictions and may provide assistance based on need alone. It is important to ask each provider about their specific eligibility criteria.

Facing unaffordable utility bills is a significant burden, but in Texas, a multi-layered safety net exists to provide critical support. By systematically exploring state programs, engaging with your utility provider, and tapping into local community resources, you can find the cash help needed to bridge the gap during difficult times. The key is proactive communication, organized documentation, and persistent outreach. Securing this assistance not only protects your family’s immediate health and safety but also provides the stability needed to address broader financial challenges. Remember, seeking help is a responsible step toward safeguarding your household, and these resources are in place for exactly this purpose.

Visit Apply for Assistance to connect with your local Community Action Agency and secure your utility bill assistance.