Installment Payday Loans vs Traditional Payday Loans?

Understanding the Basics: What Are Installment Payday Loans vs Traditional Payday Loans?

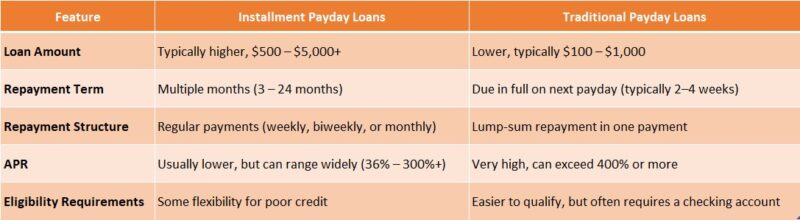

When it comes to borrowing money quickly, understanding the difference between installment payday loans vs traditional payday loans is crucial. Both options can help in times of need, but they work in different ways. Knowing these differences can help you make a better choice for your financial situation.

Traditional Payday Loans

Traditional payday loans are short-term loans that you typically pay back on your next payday. They are quick and easy to get, but they often come with high fees. You might borrow a small amount, but you need to repay it all at once, which can be tough if you’re already struggling financially.

Installment Payday Loans

On the other hand, installment payday loans offer a more flexible repayment option. Instead of paying everything back at once, you can pay in smaller amounts over time. This can make it easier to manage your budget and avoid falling into a cycle of debt. Here are some benefits of flexible repayment payday loans:

- Easier to manage: Smaller payments can fit better into your monthly budget.

- Less stress: You won’t feel overwhelmed by a large payment due all at once.

- Better for your credit: Making regular payments can help improve your credit score.

CashLoanFunded: Quick Cash for Your Needs!

How Do Payment Structures Differ Between Installment and Traditional Payday Loans?

When it comes to borrowing money, understanding the differences between installment payday loans and traditional payday loans is crucial. These two types of loans can help in times of need, but they work quite differently. Knowing how their payment structures differ can help you make a better choice for your financial situation.

Traditional Payday Loans

Traditional payday loans are typically short-term loans that you must repay in one lump sum. This means if you borrow $500, you’ll need to pay back that full amount, plus any fees, on your next payday. This can be tough if you’re already struggling financially, as it can lead to a cycle of debt.

Installment Payday Loans

On the other hand, installment payday loans offer a more flexible repayment option. Instead of paying everything back at once, you can repay the loan in smaller, manageable installments over a set period. This can ease the financial burden, making it easier to budget your expenses each month.

Key Differences

- Repayment Terms: Traditional loans require full repayment quickly, while installment loans spread payments over time.

- Flexibility: Installment payday loans provide flexible repayment options, making them less stressful for borrowers.

- Financial Impact: With installment loans, you’re less likely to fall into a debt trap, as payments are more manageable.

Get Approved Fast at CashLoanFunded – No Hassle!

The Pros and Cons of Choosing Installment Payday Loans Over Traditional Options

When it comes to borrowing money quickly, many people wonder about the differences between installment payday loans and traditional payday loans. Understanding these options is crucial, especially if you need cash fast. So, let’s dive into the pros and cons of choosing installment payday loans over traditional options!

The Basics of Each Loan Type

- Traditional Payday Loans: These are short-term loans that you typically pay back in one lump sum on your next payday. They can be convenient but often come with high fees.

- Installment Payday Loans: Unlike traditional loans, these allow you to repay the borrowed amount in smaller, manageable installments over time. This can make them easier to handle financially.

Pros of Installment Payday Loans

- Flexible Repayment: With flexible repayment payday loans, you can spread out your payments, making it less stressful on your budget.

- Lower Fees: Often, the fees associated with installment loans can be lower than those of traditional payday loans, especially if you need more time to pay back the loan.

Cons of Installment Payday Loans

- Longer Commitment: While they offer flexibility, you might be in debt for a longer period.

- Potential for Higher Interest: Depending on the lender, installment loans can sometimes have higher interest rates than traditional payday loans, so it’s essential to shop around.

Also Read: What Are Flexible Repayment Payday Loans?

Are Installment Payday Loans a Safer Choice for Borrowers?

When it comes to borrowing money quickly, many people wonder about the differences between installment payday loans and traditional payday loans. Understanding these differences is crucial because they can significantly impact your financial health. Let’s dive into the details and see if installment payday loans are a safer choice for borrowers.

Understanding the Basics

Traditional payday loans usually require you to pay back the entire amount on your next payday. This can create a financial strain if you’re not prepared. On the other hand, installment payday loans allow you to repay the loan in smaller, manageable payments over time. This flexibility can make a big difference!

Key Benefits of Installment Payday Loans

- Flexible Repayment: You can spread out your payments, making it easier to budget.

- Lower Risk of Debt Cycle: With smaller payments, you’re less likely to fall into a cycle of debt.

- Better Financial Planning: You can plan your expenses better when you know exactly how much you need to pay each month.

In summary, when comparing installment payday loans vs traditional payday loans, the former often provides a safer and more manageable option for borrowers. This flexibility can help you avoid the stress of a lump-sum payment and keep your finances on track.

What to Consider When Deciding Between Installment and Traditional Payday Loans?

When you’re in a financial pinch, understanding the differences between installment payday loans vs traditional payday loans can make a big difference. Each option has its own pros and cons, and knowing what to consider can help you choose the right one for your needs.

Repayment Structure

- Traditional Payday Loans: These loans typically require you to pay back the entire amount in one lump sum on your next payday. This can be tough if you’re already short on cash.

- Installment Payday Loans: These loans allow you to repay the amount in smaller, manageable chunks over time. This flexibility can ease the stress of repayment, making it a popular choice for many borrowers.

Interest Rates and Fees

It’s also essential to look at the interest rates and fees. Traditional payday loans often come with higher fees due to their short repayment terms. In contrast, flexible repayment payday loans may have lower rates, making them more affordable in the long run.

Your Financial Situation

Lastly, consider your financial situation. If you can manage a lump sum payment, a traditional payday loan might work. However, if you need more time to pay back, an installment payday loan could be the better option. Always weigh your choices carefully!

How CashloanFunded.com Can Help You Navigate Your Loan Options

When it comes to borrowing money, understanding the differences between installment payday loans vs traditional payday loans is crucial. Each option has its own set of benefits and drawbacks, which can significantly impact your financial situation. At CashloanFunded.com, we’re here to help you make sense of these choices and find the best fit for your needs.

What Are Traditional Payday Loans?

Traditional payday loans are short-term loans that you typically repay on your next payday. They are quick to obtain but can come with high fees. If you’re in a pinch, they might seem like a good option, but they can lead to a cycle of debt if not managed carefully.

The Benefits of Installment Payday Loans

On the other hand, flexible repayment payday loans, or installment payday loans, allow you to pay back the loan in smaller, manageable amounts over time. This can make it easier to budget and avoid the stress of a lump-sum payment. Here are some benefits:

- Lower Monthly Payments: Spread out your repayment over several months.

- Easier to Manage: Smaller payments can fit better into your budget.

- Less Risk of Debt Cycle: Reduces the chance of falling into a debt trap.

At CashloanFunded.com, we guide you through these options, helping you choose the loan that aligns with your financial goals.

Real-Life Scenarios: When to Choose Installment Payday Loans vs Traditional Payday Loans

When it comes to borrowing money quickly, understanding the difference between installment payday loans vs traditional payday loans is crucial. Each option has its own benefits and drawbacks, making it essential to choose the right one based on your financial situation. Let’s explore real-life scenarios to help you decide which loan type might work best for you.

Traditional Payday Loans: Quick Cash for Emergencies

Imagine you have an unexpected car repair bill. A traditional payday loan can provide you with quick cash, often within a day. However, you’ll need to pay it back in full by your next payday, which can be challenging if you’re already tight on funds. This type of loan is best for urgent needs but can lead to a cycle of debt if not managed carefully.

Installment Payday Loans: Flexible Repayment Options

Now, picture needing money for a medical expense but wanting to avoid the stress of a lump-sum payment. Here, flexible repayment payday loans come into play. With installment payday loans, you can repay the loan in smaller, manageable amounts over several weeks or months. This option is great for those who prefer a steadier approach to repayment, making it easier to budget and avoid financial strain.

FAQs

🔁 What is the main difference between installment payday loans and traditional payday loans?

Traditional payday loans are repaid in one lump sum, usually on your next payday. Installment payday loans let you repay the loan over multiple scheduled payments, often weekly or biweekly.

📆 How long do I have to repay each type of loan?

Traditional payday loans typically require repayment within 14 to 30 days. Installment payday loans can extend from a few weeks up to 12 months, depending on the lender and state laws.

💰 Which loan offers more flexibility with payments?

Installment payday loans offer greater flexibility, allowing you to spread out payments over time. This can make it easier to manage your budget and avoid default.

⚠️ Do installment payday loans cost more in the long run?

They can—because the longer term means more time for interest to build up. However, they may be less risky than traditional payday loans that often lead to rollovers and extra fees.

✅ Which is better for people with bad credit?

Both may be accessible to those with poor credit, but installment payday loans can be easier to repay and may even help establish better financial habits if paid on time.

Secure Funds at CashLoanFunded – Get Cash Fast!

🔗At ExpressCash, we’re here to help guide you through the process and find the right financial solution for your specific situation.

Get a Loan!

"*" indicates required fields