Best Emergency Funded Cash Loans for Urgent Bills

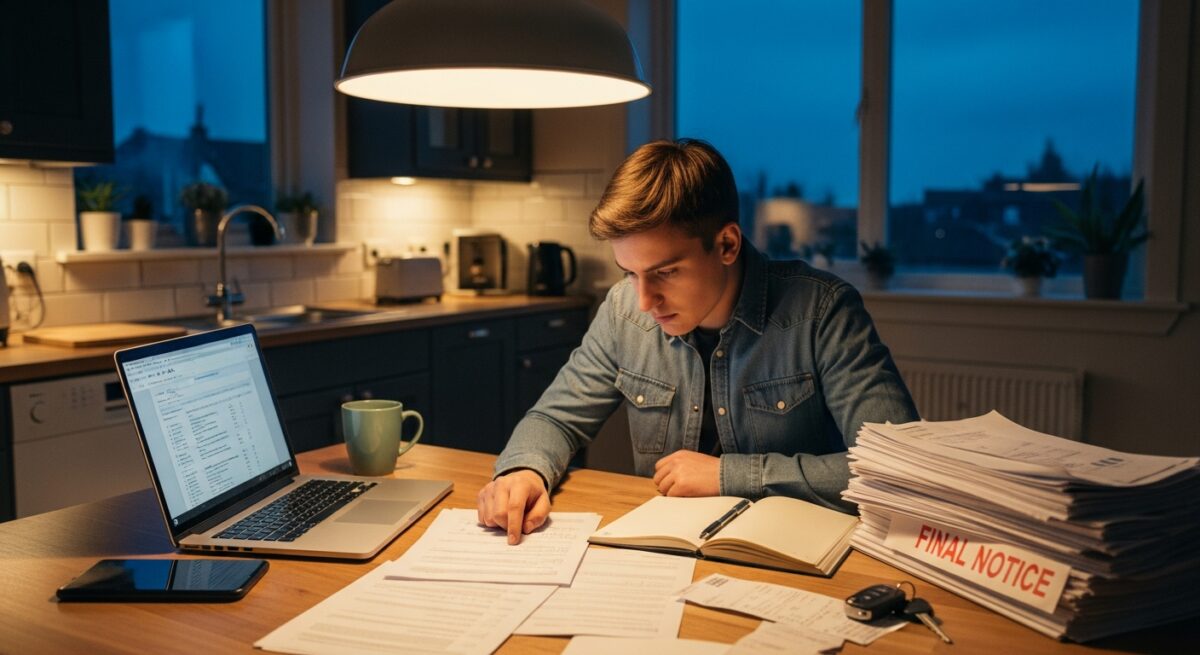

When an unexpected bill arrives, the pressure can be immense. Your car breaks down, a medical expense arises, or your home needs an urgent repair. In these moments, waiting for your next paycheck isn’t an option. You need access to cash, and you need it quickly. This is where emergency funded cash loans can serve as a critical financial bridge. However, navigating the landscape of fast cash loans requires careful consideration to avoid predatory terms and ensure you’re choosing a solution that helps, rather than harms, your financial situation. This guide will walk you through the best types of emergency loans for urgent bills, how to evaluate them, and strategies to use them responsibly.

Visit Get Emergency Funding to compare your emergency loan options and find a responsible solution for your urgent bills.

Understanding Your Emergency Loan Options

Not all emergency loans are created equal. The “best” option is highly dependent on your individual circumstances, including your credit score, the amount you need, and how quickly you can repay it. The key is to match the loan product to your specific need and repayment capacity. Rushing into the first offer you see can lead to a cycle of debt that is difficult to escape. Instead, take a systematic approach to evaluate the avenues available to you.

Traditional personal loans from banks or credit unions often offer the most favorable terms, including lower interest rates and longer repayment periods. However, they typically require a credit check and may take several days to fund, which might not align with a true emergency timeline. Online lenders have streamlined this process, offering faster approval and funding, sometimes within 24 hours, though often at higher interest rates, especially for borrowers with less-than-perfect credit. For residents of specific states, like Ohio, exploring localized options can be beneficial. For instance, in our guide on same day cash loans Ohio, we explain how state-specific regulations and lenders can impact your choices and speed of funding.

Key Features of a Responsible Emergency Loan

When bills are piling up, it’s easy to focus solely on the immediate influx of cash. A responsible borrower must look beyond the loan amount to the terms that will govern the repayment period. Scrutinizing these features is what separates a helpful financial tool from a debt trap.

First, examine the Annual Percentage Rate (APR). This figure includes the interest rate plus any fees, giving you a true picture of the loan’s annual cost. For emergency loans, APRs can vary wildly, from single digits for excellent-credit borrowers to triple digits for certain short-term products. Second, understand the fee structure. Are there origination fees, late payment fees, or prepayment penalties? Transparent lenders will disclose these upfront. Third, consider the repayment schedule. Is it a single lump-sum payment due on your next payday, or is it an installment loan with fixed monthly payments over several months? The latter often provides more manageable cash flow.

To help you compare, here are the core features to evaluate for any emergency cash loan:

- Clear, Fully Disclosed APR: The total cost of borrowing should be unambiguous before you sign.

- Flexible and Affordable Repayment Terms: Payments should fit within your budget without requiring another loan.

- Speed of Funding: The lender should specify a realistic timeline from approval to cash-in-hand.

- Transparent Fee Schedule: No hidden charges for application, processing, or early repayment.

- Positive Customer Service Reviews: Look for lenders with a reputation for fair treatment and clear communication.

Navigating Loans with Bad Credit

A less-than-ideal credit score can feel like a barrier when facing an emergency. Many traditional lenders may deny your application, pushing you toward alternative, and often more expensive, options. It’s crucial to understand the landscape for bad credit emergency loans. Some online lenders specialize in working with borrowers who have poor or limited credit histories. They may use alternative data, like your banking history or employment record, to make a lending decision. However, this convenience and accessibility come at a cost, typically in the form of significantly higher interest rates.

Before applying, consider taking steps to improve your application. Providing proof of stable income, offering collateral for a secured loan (if possible), or applying with a co-signer who has good credit can help you secure better terms. Most importantly, be wary of lenders who guarantee approval without a credit check. These are often associated with predatory practices. A legitimate lender will always perform some level of financial assessment. The goal is to find a loan that addresses your immediate crisis without creating a larger, long-term financial problem due to unsustainable costs.

Visit Get Emergency Funding to compare your emergency loan options and find a responsible solution for your urgent bills.

The Application Process and What to Expect

Applying for an emergency funded cash loan is generally a straightforward, digital process. Being prepared can speed it up considerably. You will typically need to provide personal identification (like a driver’s license or SSN), proof of income (recent pay stubs or bank statements), and details for your active checking account. The lender will perform a credit check, which may be a “soft” inquiry initially and a “hard” pull upon formal application. This process can often be completed in minutes online.

Once approved, funding time is the critical factor. Many of the best emergency funded cash loans for urgent bills promise same-day or next-business-day funding. This is usually accomplished via direct deposit into your bank account. It’s important to note that the exact timing can depend on your bank’s policies for processing ACH transfers. Always read the fine print regarding funding timelines, and if possible, apply early in the day to increase the chances of same-day processing. Remember, receiving the funds quickly is only half the equation, you must have a concrete plan for repayment from the moment the money hits your account.

Frequently Asked Questions

What is the difference between a payday loan and an emergency installment loan?

Payday loans are typically small, short-term loans due in full (plus fees) on your next payday. Emergency installment loans are also for urgent needs but are repaid in multiple, scheduled payments over a longer period (e.g., 3 to 24 months). Installment loans generally offer more manageable repayment terms, though APRs can still be high for bad-credit borrowers.

Can I get an emergency loan with no credit check?

Truly “no credit check” loans from legitimate institutions are rare. Most lenders will check your credit or use an alternative method to assess your financial behavior. Be extremely cautious of offers claiming no credit check, as they may be predatory or scams seeking upfront fees.

How can I avoid scams when looking for fast cash?

Legitimate lenders never guarantee approval before reviewing your application or ask for upfront fees via gift cards or wire transfers. Always verify the lender is licensed to operate in your state and check for physical contact information and customer reviews from independent sources.

Are there alternatives to emergency loans for urgent bills?

Yes, always explore alternatives first. These include negotiating a payment plan with the bill provider, seeking assistance from local charities or religious organizations, using a credit card cash advance (if you have one), or borrowing from friends or family under clear terms. These options often come with lower or no financial cost.

What should I do if I can’t repay my emergency loan on time?

Contact your lender immediately. Many reputable lenders offer hardship programs or can help you revise your payment plan. Ignoring the problem will lead to late fees, damage to your credit score, and potentially collections activity. Proactive communication is key.

Choosing the right emergency funded cash loan for urgent bills is a significant financial decision that requires calm assessment, even under pressure. By prioritizing transparent lenders, understanding the full cost of borrowing, and having a solid repayment strategy, you can use these tools to navigate a short-term crisis without jeopardizing your long-term financial health. The ultimate goal is to resolve the immediate emergency and return to a path of stability, using the experience to inform and strengthen your future financial planning.

Visit Get Emergency Funding to compare your emergency loan options and find a responsible solution for your urgent bills.