100 Payday Loan: Fast and Easy Application

When unexpected expenses arise, a 100 payday loan can be a lifesaver. These loans offer a fast and easy application process, making them ideal for emergencies. Whether it’s a car repair or a medical bill, knowing how to navigate these loans can help you get back on track quickly.

What is a 100 Payday Loan?

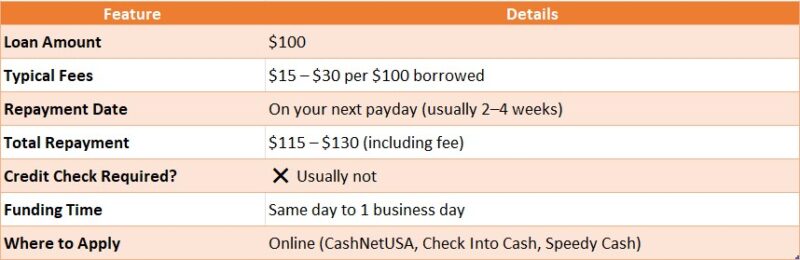

A 100 payday loan is a short-term loan designed to cover urgent financial needs. It’s called a payday loan because it’s typically due on your next payday. This means you can access cash quickly without a lengthy approval process.

Benefits of 100 Payday Loans

- Fast Approval: Most applications are processed within minutes.

- Same-Day Loans: If approved, you can receive funds the same day.

- Simple Application: Just provide basic information like your income and bank details.

Important Considerations

While these loans are convenient, they come with higher interest rates. Always read the terms carefully and ensure you can repay the loan on time to avoid additional fees.

CashLoanFunded: Quick Cash for Your Needs!

Why Choose a 100 Payday Loan for Quick Cash?

When life throws unexpected expenses your way, a 100 payday loan can be a lifesaver. These loans offer a fast and easy application process, allowing you to access cash quickly. Whether it’s a medical bill or a car repair, having quick cash can relieve stress and help you manage your finances better.

Fast Approval Process

With a 100 payday loan, you can expect a speedy approval process. Most lenders provide same-day loans, meaning you can get the money you need within hours. This is perfect for emergencies when time is of the essence.

Simple Application

The application for a 100 payday loan is straightforward. You can often apply online, filling out a few basic details. No complicated paperwork means you can focus on what matters most—solving your financial issue quickly!

Flexible Repayment Options

Many lenders offer flexible repayment options, making it easier to pay back your loan without added stress. You can choose a plan that fits your budget, ensuring you stay on track with your finances.

Get Approved Fast at CashLoanFunded – No Hassle!

The Fast and Easy Application Process Explained

Unexpected expenses can be stressful, but understanding the application process for a 100 payday loan can help you manage them effectively. With the right steps, you can secure emergency and same-day loans quickly, easing your financial burden.

Simple Steps to Apply

- Visit the Lender’s Website: Find a reputable lender with a straightforward application process.

- Fill Out the Application: Enter your personal details, such as income and expenses, in a user-friendly format.

- Submit Your Application: After completing the form, submit it for review. Most lenders respond almost instantly.

Quick Approval and Funding

- Fast Approval: Many lenders provide quick decisions, often within minutes.

- Same-Day Funding: If approved, you could receive your funds on the same day, allowing you to address your financial needs without delay.

In summary, the 100 payday loan application process is designed to be efficient and user-friendly. By following these steps, you can secure the funds you need quickly, making it easier to handle those unexpected financial challenges.

Also Read: Emergency and Same-Day Loans for Fast Cash Relief

What Are the Eligibility Requirements for a 100 Payday Loan?

When unexpected expenses arise, a 100 payday loan can be a quick solution. These loans offer a fast and easy application process, making them ideal for emergencies. But before you dive in, it’s essential to understand the eligibility requirements to ensure a smooth experience.

To qualify for a 100 payday loan, you typically need to meet a few basic criteria. Here’s what lenders usually look for:

- Age: You must be at least 18 years old.

- Income: A steady source of income is crucial. This can be from a job, benefits, or other reliable sources.

- Bank Account: Most lenders require you to have an active bank account for fund transfers.

- Residency: You need to be a resident of the state where you’re applying for the loan.

Meeting these requirements can help you secure emergency and same-day loans quickly, giving you peace of mind when you need it most.

How to Maximize Your Chances of Approval for a 100 Payday Loan

A 100 payday loan can be a lifesaver when you’re facing financial difficulties. With a quick and simple application process, these loans offer fast cash for emergencies. To increase your chances of approval, consider the following tips.

Understand Your Needs

Before applying, clearly define your financial needs. Whether it’s an unexpected bill or a medical emergency, knowing the exact amount you need helps prevent borrowing more than necessary, which can complicate repayment.

Check Your Credit Score

Although payday loans usually have relaxed requirements, a good credit score can enhance your approval chances. Check your score in advance and resolve any issues, as a strong score indicates to lenders that you’re a responsible borrower.

Prepare Your Documents

Collect all necessary documents before applying, such as proof of income, identification, and bank statements. Being organized and having everything ready can expedite the application process and show lenders that you are prepared.

The Benefits of 100 Payday Loans: Speed and Convenience

When unexpected expenses arise, a 100 payday loan can be a lifesaver. These loans offer a fast and easy application process, allowing you to access cash quickly. Whether it’s a medical bill or a car repair, having a reliable option like this can ease your financial stress.

Quick Access to Funds

With a 100 payday loan, you can get money in your account often on the same day you apply. This speed is crucial during emergencies when you need cash fast. No long waiting periods mean you can tackle your financial issues head-on.

Simple Application Process

Applying for a payday loan is straightforward. You usually just need to provide basic information like your income and bank details. Many lenders offer online applications, making it even easier to get started.

- Emergency and Same-Day Loans: These loans are designed for urgent needs.

- Minimal Documentation: Less paperwork means less hassle.

In just a few clicks, you can have the funds you need without complicated procedures.

Are There Any Risks Involved with 100 Payday Loans?

When considering a 100 payday loan, it’s crucial to understand the associated risks. These loans provide a fast and easy application process, but they can lead to financial troubles if not handled properly. Being aware of these risks can help you make better decisions in emergencies.

High-Interest Rates

A significant risk of a 100 payday loan is the high-interest rates. These loans often come with fees that accumulate quickly, making timely repayment difficult. Without caution, you could find yourself trapped in a debt cycle.

Short Repayment Terms

Another issue is the short repayment terms, typically requiring repayment within a few weeks. This can be challenging if you’re already struggling financially. Missing a payment may incur additional fees, worsening your situation.

Potential for Debt Cycle

Lastly, relying on emergency and same-day loans can lead to a debt cycle. If you borrow to pay off another loan, you might end up in deeper financial trouble. Always assess your repayment ability before applying for a 100 payday loan.

How to Repay Your 100 Payday Loan Responsibly

When you find yourself in a tight spot financially, a 100 payday loan can be a quick solution. With a fast and easy application process, these loans are designed to help you cover unexpected expenses. However, repaying your loan responsibly is just as important as getting the funds you need.

Understanding Your Loan Terms

Before you take out a 100 payday loan, make sure you understand the terms. Know the repayment date and the total amount due. This way, you can plan your budget accordingly and avoid any surprises.

Create a Repayment Plan

- Set aside funds: As soon as you receive your loan, set aside the amount you need for repayment. This ensures you won’t spend it on other things.

- Stick to your budget: Adjust your spending habits to accommodate the loan repayment. This can help you avoid falling into a cycle of debt.

By following these simple steps, you can repay your emergency and same-day loans without stress. Remember, responsible repayment not only helps you avoid fees but also builds your credit for future needs.

Customer Experiences: Real Stories with 100 Payday Loans

When life throws unexpected expenses your way, a 100 payday loan can be a lifesaver. With a fast and easy application process, many people have found relief through emergency and same-day loans. Let’s dive into some real stories that highlight how these loans have made a difference.

Real Stories of Relief

- Sarah’s Surprise Car Repair: Sarah’s car broke down unexpectedly. With a 100 payday loan, she quickly covered the repair costs and got back on the road the same day.

- Mike’s Medical Emergency: Mike faced an unexpected medical bill. He applied for a same-day loan and received the funds within hours, easing his worries about the expenses.

Why Customers Choose 100 Payday Loans

Many customers appreciate the simplicity of the application process. They often mention how easy it is to fill out the forms online. Plus, the quick approval means they can tackle their emergencies without delay. This convenience is why so many turn to 100 payday loans when they need help.

How CashLoanFunded.com Can Help You Secure Your 100 Payday Loan

When unexpected expenses arise, a 100 payday loan can be a lifesaver. With a fast and easy application process, you can get the funds you need quickly. This is especially important for emergencies where time is of the essence. At CashLoanFunded.com, we understand how crucial it is to access money when you need it most.

Our platform simplifies the process of obtaining emergency and same-day loans. Here’s how we make it easy for you:

- Quick Application: Fill out a simple online form in minutes.

- Fast Approval: Get approved quickly, often within hours.

- Direct Deposits: Funds are transferred directly to your bank account, so you can access them right away.

With CashLoanFunded.com, securing your 100 payday loan is straightforward. We guide you through each step, ensuring you understand the terms and conditions. Plus, our customer support is always available to answer any questions. Don’t let financial stress hold you back; let us help you get back on track!

FAQs

💵 Can I get a $100 payday loan with no credit check?

Yes, many lenders offer $100 payday loans without performing a hard credit check. They typically assess your income and employment status instead.

⚡ How fast can I receive a $100 payday loan?

If approved, you can often receive the funds the same day or by the next business day, depending on the lender and your bank’s processing times.

📝 What do I need to qualify for a $100 payday loan?

Basic requirements include being at least 18 years old, having a steady income, a valid ID, and an active checking or savings account.

📅 How long do I have to repay a $100 payday loan?

Repayment terms are usually short—typically your next payday, ranging from 7 to 30 days. Some lenders may offer extensions or installment options.

❗ What are the risks of taking a $100 payday loan?

While helpful in emergencies, payday loans can come with high fees and interest. Failing to repay on time may lead to additional charges or impact your credit.

Secure Funds at CashLoanFunded – Get Cash Fast!

🔗At ExpressCash, we’re here to help guide you through the process and find the right financial solution for your specific situation.

Get a Loan!

"*" indicates required fields